What is ULIP? How does it work?

A Unit Linked Insurance Plan is an insurance policy that offers the policyholder both insurance and investment, under a single plan. The premium paid by the policyholder is used to invest in units of a mutual fund, and the returns are used to provide protection to the policyholder’s family in case of his/her untimely death. The main advantage of a ULIP is that it offers the policyholder the potential to earn higher returns than traditional insurance policies. However, there are also some disadvantages to consider before investing in a ULIP.

What is a ULIP?

A ULIP is a type of life insurance policy that offers the policyholder both life insurance and investment opportunities. The investment portion of the ULIP is known as the “unit fund” and is managed by professional fund managers. The policyholder can choose to invest in different unit funds, depending on their investment goals and risk tolerance.

How does ULIPs work?

Here’s a step-by-step guide on how ULIPs work:

- When you purchase a ULIP, you need to select the tenure of the plan and decide how much premium you want to pay every year.

- Based on the tenure and premium amount, the insurer calculates the sum assured, which is the minimum guaranteed payout that your nominee will receive in case of your untimely death.

- Once you have decided on these parameters, you need to choose from a range of funds offered by the insurer, depending on your risk appetite and investment goals. These could be equity funds, debt funds or balanced funds.

- Once you have selected the fund(s), your premium will be allocated across these funds in accordance with your chosen asset allocation strategy. For example, if you have selected an 80:20 equity-debt ratio, then 80% of your premium will be invested in equity funds and 20% in debt funds.

- The fund value of your ULIP will fluctuate in accordance with the performance of the underlying assets. For example, if you have invested in equity funds, then the value of your ULIP will go up when the stock markets are doing well and vice versa.

- At the end of the policy tenure, you can either withdraw the maturity benefits or opt for a partial withdrawal.

- If you choose to withdraw the maturity benefits, then you will receive the fund value, which is the accumulated value of your premium after deducting charges, such as mortality charges, fund management charges, etc.

- If you opt for a partial withdrawal, then you can withdraw a part of the fund value while keeping the rest invested. This can be useful if you want to continue the policy for its other benefits, such as death benefit or riders.

- You can also surrender your ULIP at any time during the policy tenure. However, you will not receive the full fund value in this case and may have to pay some charges, such as surrender charges.

What are the Features of ULIP?

A ULIP is an insurance policy that offers the benefits of both insurance and investment. The premium paid by the policyholder is invested in a fund, which grows over time. The policyholder can then use the money to pay for their child’s education or other life goals.

ULIP policies have many features that make them attractive to investors. For one, they offer the potential for high returns on investment. Additionally, ULIPs offer flexibility in terms of how premiums are paid and how funds are invested. Policyholders can also withdraw money from their ULIPs at any time, making them a good option for those who need access to cash in an emergency.

Finally, ULIPs offer death benefits that can help to support your family in the event of your death. The death benefit is typically equal to the value of the policy at the time of your death, making it a valuable resource for your loved ones.

ULIP policies have many features that make them attractive to investors. For one, they offer the potential for high returns on investment. Additionally, ULIPs offer flexibility in terms of how premiums are paid and how funds are invested.

What are the different types of funds offered by ULIPs?

There are four different types of funds offered by ULIPs:

- Equity Funds

- Debt Funds

- Balanced Funds

- Money Market Funds

1. Equity Funds: Equity funds are the riskiest but have the potential to offer the highest returns. They invest in stocks and are therefore subject to market fluctuations.

2. Debt Funds: Debt funds are less risky and offer moderate returns. They invest in bonds and other fixed-income instruments.

3. Balanced Funds: Balanced funds offer a mix of both equity and debt investments, providing a balance between risk and return.

4. Money Market Funds: Money market funds are the least risky and offer stable, low returns. They invest in short-term debt instruments such as Treasury bills and commercial paper.

Is it good to invest in ULIP?

There are many factors to consider when deciding whether or not to invest in a ULIP. These include the fees associated with the policy, the investment options available, and the level of risk involved.

ULIP fees can be high, and they typically increase over time. This can eat into the returns you earn on your investment.

The investment options available with a ULIP can be limited. This can make it difficult to find an investment that meets your needs and goals.

The level of risk involved with a ULIP can be significant. This is because your investment is linked to the performance of the stock market. If the stock market declines, your investment will likely decline as well.

Before investing in a ULIP, be sure to carefully consider all of the factors involved. This will help you decide if a ULIP is right for you.

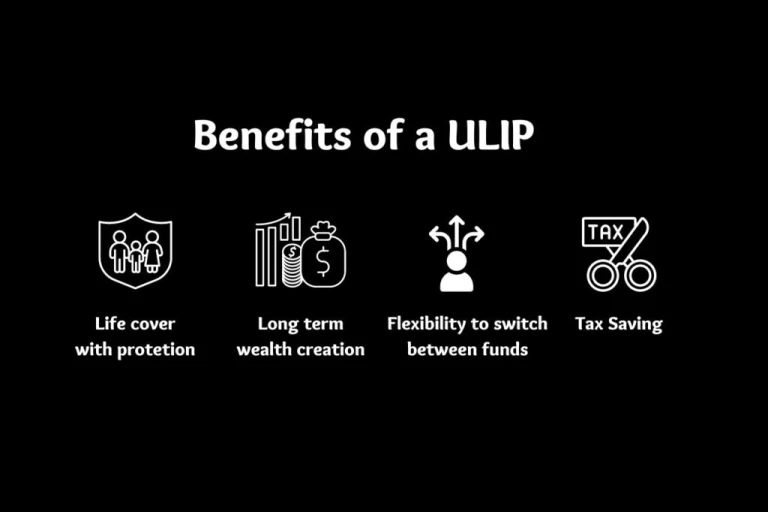

Benefits of ULIP

There are many benefits of investing in a Unit Linked Insurance Plan (ULIP). Some of the key benefits are as follows:

- ULIPs offer flexibility in terms of investment options and premium payments. You can choose to invest in different asset classes, and also switch between them as per your needs.

- ULIPs have the potential to generate higher returns as compared to traditional insurance plans. This is because they invest a portion of your premium in stock markets and other growth-oriented investments.

- ULIPs offer death benefit and maturity benefit. In case of death during the policy term, the nominee will receive the sum assured plus accrued bonuses. On maturity, you will receive the corpus that has accumulated over the years, along with any bonuses that may have been declared during the policy term.

- ULIPs also offer tax benefits under section 80C and 10(10D) of the Income Tax Act 1961.

Thus, ULIPs are a triple bonanza of monetary security for your family, capital appreciation, and tax savings.

What are the Risks of ULIP?

- ULIP policies do have some risks that policyholders should be aware of. For one, ULIPs are subject to market risk, meaning that the value of your investment can go up or down depending on economic conditions. Additionally, ULIPs typically have high fees and charges, which can eat into your investment returns.

- Additionally, ULIPs typically have surrender charges, which apply if you cancel your policy early. These charges can be high, so it’s important to make sure that you are comfortable with the terms of your policy before you commit to it.