Difference between Term Insurance and Life Insurance

Term insurance is one of the purest forms of life insurance, providing financial security to your family in the form of a life for a set period of time. With the life insurance industry developing, companies are offering a variety of policies spanning from protection to wealth development. All of these plans provide financial security, but the nature of that security varies. It is the most cost-effective sort of life insurance for protecting your loved ones’ future, since it gives a substantial life cover for a low payment. When selecting the best insurance coverage, a lot of factors must be considered. Continue reading to learn more about their various perks and how to choose the best suit for you.

Understanding Term Insurance and Life Insurance

Here is a basic overview of Term and Life Insurance Plans.

Term Insurance

A term insurance policy is a financial contract that guarantees a set amount for a set period of time. The policyholder must pay a premium for this coverage, but no more payments are required during the period.

Term insurance is a less expensive plan that can be acquired for a set length of time. Furthermore, most term insurance policies have a guaranteed minimum sum. This means that the insurer commits to pay at least this amount even if no claim is filed or a covered event occurs within the policy’s term.

Life Insurance

Life insurance plans are an excellent way to protect your family in the event of an untimely death. Furthermore, life insurance policies can help you create a financial cushion for yourself and your dependents, providing them with financial security if you die unexpectedly.

Life insurance policies are intended to provide coverage for you and any dependents who may be left behind after your death. Many plans also provide death benefits if you die as a result of an accident or sickness, which can assist cover funeral expenses and other related expenditures.

The most crucial aspect of getting a life insurance policy is understanding the coverage you are purchasing.Furthermore, you want to guarantee that enough security is provided for all of your dependents so that they are not left without funds or savings if one of you dies unexpectedly.

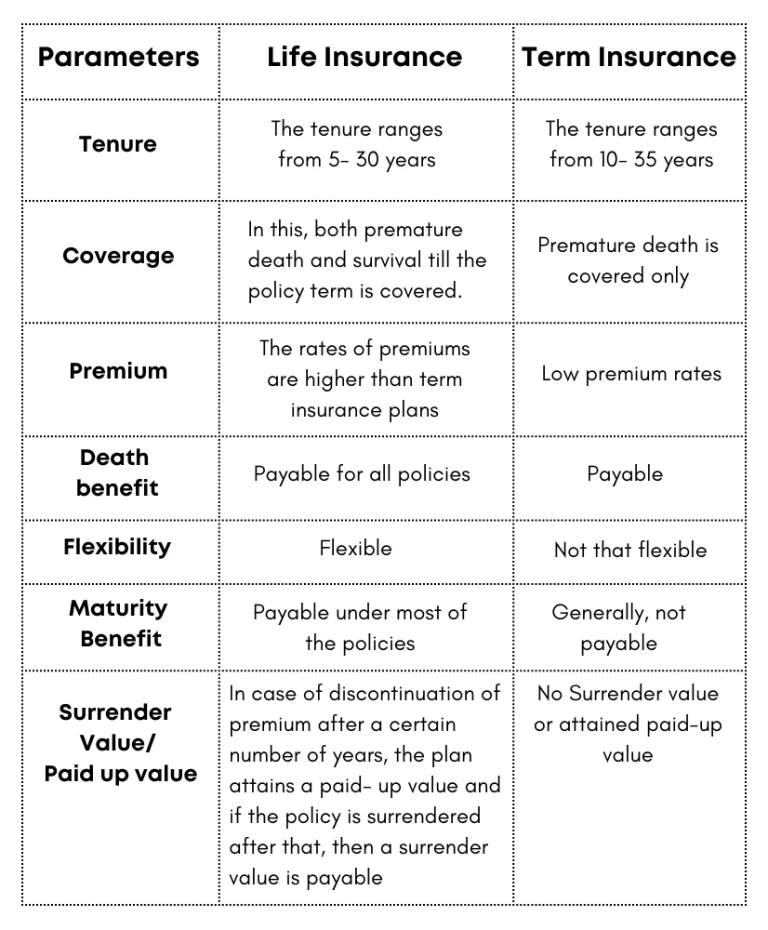

Term Insurance Vs. Life Insurance

Overview

Let us now go over the points described above in further depth.

Coverage

The recipient of life insurance receives a death benefit, whereas the policyholder receives a cash reward. Term insurance also covers the policyholder’s early death within the time period indicated in the policy agreement. Life insurance, on the other hand, covers both premature death and surviving until the policy’s maturity.

Premium

Life insurance premiums are often higher than term insurance premiums since these plans cover the entire life.

Coverage Duration

Life insurance covers you for a specific length of time (5-30 years), whereas term insurance covers you for up to 35 years.

Bonus and other additions

When you have paid your premiums for at least one year, most life insurance companies will add a bonus to your policy. Term plans often do not include any bonuses or extra benefits.

Under term insurance contracts, the basic sum assured is paid if the policyholder dies. Some life insurance plans, on the other hand, include bonus adds, guaranteed additions, loyalty additions, and other perks.

Paid up and surrender

The process of applying for term insurance is known as surrendering your whole life policy (the one you have now). There is no paid-up or surrender value acquired.

If premiums on a life insurance policy are stopped after a certain number of years, the policy gains a paid-up value. If you submit after that, you will be paid a surrender value.

Flexibility

Whole life insurance policies provide more flexibility than term policies because term insurance has no surrender or paid-up value and no maturity advantages.

The bottom line

Both life insurance and term insurance have their advantages and disadvantages. Term insurance plans are essential for everyone since they provide financial protection in the event of a premature death. Knowing the distinction between both policies allows one to select the best plan for themselves and their loved ones.

Click here for Top 10 Life Insurance Companies in India.

Follow us on Instagram.