How to Invest in Roth IRA in India?

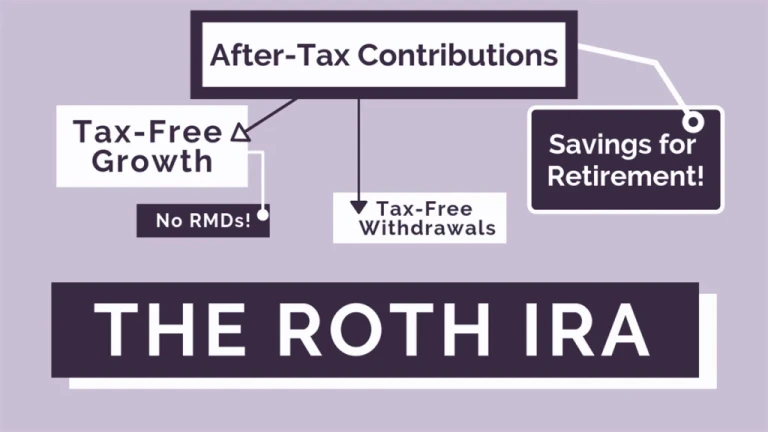

If certain requirements are met, a Roth IRA is an individual retirement account that is generally tax-free upon distribution. This article helps delve into details on how to invest in Roth IRA in India!

What is a Roth IRA?

A Roth IRA is a retirement account that lets you invest money tax-free. You can contribute up to $5,500 per year, which equals $6,500 if you’re 50 or older. The best part is that the money stays invested without penalties until you reach retirement age.

There are a few things to keep in mind when you invest in Roth IRA. First, make sure the investment is appropriate for your risk tolerance and investment goals. Second, make sure you have a qualified financial advisor to help you choose the right investments and maximize your return. Finally, remember to regularly withdraw your contributions to keep them invested and grow over time.

What are the advantages of a Roth IRA?

A Roth IRA is a retirement account that allows you to save money tax-free. Here are the advantages of investing in a Roth IRA:

-You can contribute up to $5,500 per year ($6,500 if you are 50 or older).

-You will not have to pay taxes on the contributions until you make them untaxable by withdrawing the money or using it for qualified expenses.

-Your account will grow tax-free, which could add up to a lot of money over the years.

-If you withdraw funds before you reach age 59 1/2, you will owe income taxes on the amount withdrawn, as well as a 10% penalty.

How does a Roth IRA make you money?

A Roth IRA is a retirement account that lets you save money in after-tax dollars. When you make contributions to a Roth IRA, the money is not taxed when you withdraw it. This means that your contributions will grow tax-free over time.

Roth IRA contributions are made with after-tax dollars, so the money goes into the account immediately and does not have to be paid back like a loan. In addition, interest earned on your Roth IRA investments is also tax-free.

There are several advantages to using a Roth IRA as your retirement savings account. First, contributions are made with after-tax dollars, so you won’t be penalized for saving more money. Second, interest earned on your investments is also tax-free, which can add up over time. And finally, if you need to withdraw money from your Roth IRA later on in life, you won’t have to pay any income taxes on the money.

Who can invest in a Roth IRA?

There are a few requirements to be eligible to invest in a Roth IRA. The first requirement is that you must be at least age 18 or older, have earned income, and not be covered by an employer retirement plan. The second requirement is that your modified adjusted gross income (MAGI) must be less than $100,000 if you are single, or $200,000 if you are married and filing jointly. Finally, your assets must be situated in the United States.

There are a few other eligibility requirements as well. For example, you must have had an account with a qualified financial institution for at least three months before opening a Roth IRA. Additionally, your Roth IRA contributions cannot exceed the annual limit of $5,500 if you are single or $11,000 if you are married and filing jointly.

How can I purchase a Roth IRA?

Taxes and fees associated with investing in a Roth IRA vary depending on your location, but can be as low as $10/year.

To get started, search online for reputable providers in your area. You can also compare fees and investments online. Once you’ve selected a provider, complete the account opening process and fund your account with cash or savings.

Once your Roth IRA is open, continue to make contributions on a regular basis, regardless of market conditions. This will help you grow your investment over time while preserving your tax break.

How to invest in Roth IRA from India?

If you’re thinking about how to invest in Roth IRA from India, there are a few things to keep in mind.

First and foremost, make sure that you’re eligible to invest in a Roth IRA. This means that you have earned income within the last year that’s above the annual contribution limit (currently $5,500 for individuals, $11,000 for married couples filing jointly) and your adjusted gross income (AGI) is below certain thresholds. Second, make sure to research the various Roth IRA providers out there before making a decision. Not all of them offer investment products specifically designed for foreign investors.

And finally, be mindful of the tax implications of investing in a Roth IRA from outside the United States – depending on your personal situation, you might be subject to additional taxes when you withdraw your contributions or earnings later on.

Is there an Indian equivalent to a Roth IRA?

There is no equivalent to the Roth IRA in India, but there are a few similar retirement savings vehicles that may be of interest. For example, the traditional IRA offers similar benefits to the Roth IRA. Additionally, individual 401(k) plans offer many of the same benefits as Roth IRAs, including tax-free growth and potential tax breaks down the road. If you’re interested in exploring these options, speak with a financial advisor to see which would be best for you.