How to Invest in Treasury Bonds & Treasury Bills in India

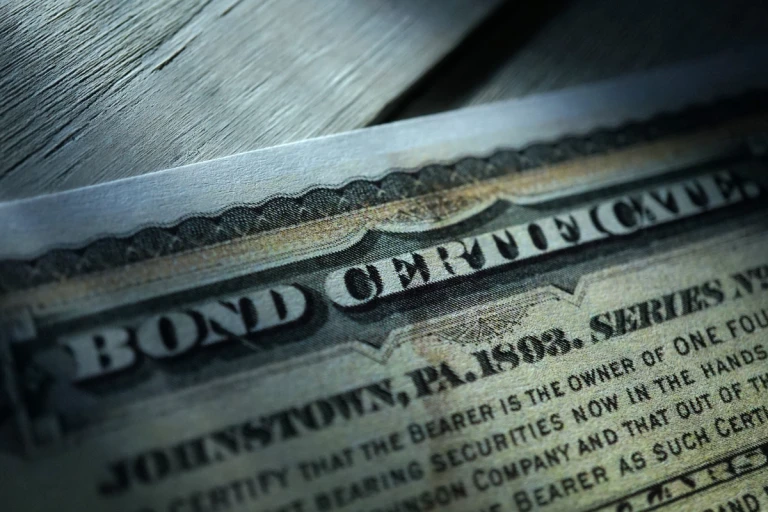

Investing in treasury bonds and bills in India presents an array of opportunities for investors seeking low-risk, government-backed instruments. Treasury bonds and bills, often referred to as government securities (G-Secs), offer a secure avenue for individuals to invest in the country's debt market. Understanding how to navigate these investments is crucial for those seeking stable returns and capital preservation. This blog aims to delve into the intricacies of investing in treasury bonds and bills in India, providing comprehensive insights, strategies, and steps to guide potential investors through this rewarding yet relatively secure investment landscape.

How do you Invest in Government Bonds?

When government funds require a boost, they turn to the public through the issuance of bonds. Government bonds, known for their stability, offer investors an opportunity to participate in this financial avenue. The current yield for a 10-year government bond stands at 7.244% as of May 2022, providing consistent returns to investors over time. But how does one venture into purchasing these bonds? There are two primary routes to buy government bonds:

GILT Mutual Funds

Direct Investment

Participation in Bidding

GILT Mutual Funds

Investing in government bonds through GILT mutual funds is a prevalent method. These funds channel investments into bonds issued by state and central governments. Investors lend money to the government, receiving interest payments and eventual capital appreciation upon maturity. Government bonds boast zero-credit risk, virtually eliminating the chances of default, making them an attractive option for risk-averse investors. Furthermore, with investments secured in government-backed securities, capital protection is ensured.

Direct Investment

For those preferring a more hands-on approach, direct investment in government bonds is an alternative. With a trading and Demat account from any bank or NBFC in India, investors can engage in trading and investment activities across multiple government securities. Registering on the stock exchange and placing buy orders for government bonds becomes accessible once the account is established.

Participation in Bidding

Investors can also procure government bonds through stockbrokers by participating in non-competitive bidding (NCB). Retail investors can conveniently place bids through the goBID web portal or NSE goBID mobile application. The yield is determined based on the bids received, allowing investors to engage in these auctions after opening a current account or subsidiary general ledger account.

Treasury Bills Vs Treasury Bonds

TREASURY BILLS | TREASURY BONDS | |

Meaning | T-bills are transient money market instruments that are issued by the public authority. | T-bonds are long-term capital market instruments that are issued by the public authority. |

Fluctuations in Price | Cost change exceptionally less since it matures quicker than expected. | Cost varies more in bonds because of the longer maturity time frame. |

Different Types | 91 Day Bill, 182 Day Bill, and 384 Day Bill. | Corporate bonds, zero-coupon bonds, municipal bonds, and so forth. |

Payment of Interest | T-bills is issued at a discounted price. | T-bonds are not issued at a discounted cost, but pay interest twice a year and pay face value at maturity. |

Period to Maturity | They are issued with a maturity of one year or less. | T-bonds are issued with a maturity period equivalent to or over 10 years. |

How to invest in Treasury Bills?

Purchasing Treasury Bills in India offers multiple avenues for interested investors:

Primary Auctions

Participate in auctions conducted by the Reserve Bank of India (RBI), where eligible participants like banks and specific non-banking financial companies place bids.

Secondary Markets

After the initial auction, T-Bills become available for trading on the secondary market. Here, you can acquire T-Bills through brokers or authorized banks dealing in government securities.

Retail Direct Gilt (RDG) Account

Open an RDG account with a registered intermediary, such as a bank or non-banking financial company. This account facilitates direct transactions with government securities, including Treasury Bills.

Also read: Get Loan Against Credit Card in India

The Bottom Line

In conclusion, investing in Treasury Bonds and Treasury Bills in India offers a variety of avenues, from primary auctions to secondary markets and specialized accounts. These government-backed investment instruments provide opportunities for diverse investors, catering to varying risk appetites and preferences. Understanding these investment routes empowers individuals to make informed decisions aligning with their financial goals and risk tolerance. Whether through primary auctions, secondary market trades, or specialized accounts, the accessibility and flexibility of investing in Treasury Bonds and Bills contribute to a robust investment portfolio in India's financial landscape.

Follow us on Instagram.