How to invest in a bear market?

A bear market is a market where the prices of securities are falling or are expected to fall. Bear markets are characterized by a high degree of uncertainty, investor pessimism, and decreased market liquidity. The first step to investing in a bear market is to have a clear investment strategy.

Some simple questions to ask yourself:

- What asset class are you looking to invest in?

- What is your risk tolerance?

- What are your goals?

Once you have answers to these questions, you can start researching investments.

What is a bear market?

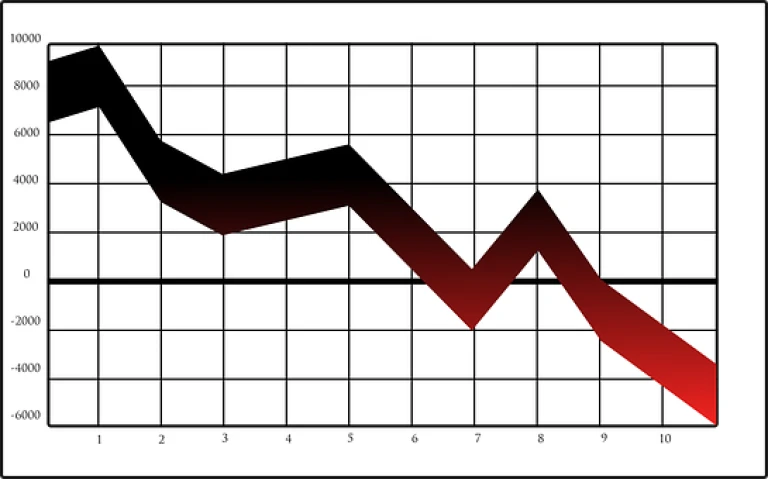

A bear market is a term used to describe a falling stock market. It is typically associated with a period of economic decline. A bear market can last for months or even years.

When the stock market is in a bear market, it can be difficult to find stocks that are worth investing in. However, there are still opportunities to make money in a bear market. Here are a few tips on how to invest in a bear market:

How long does a bear market last?

There is no definitive answer to this question, as bear markets can last for varying lengths of time. However, generally speaking, bear markets tend to last for around 12 months.

During a bear market, stock prices will typically fall by 20% or more. This can be a difficult time for investors, as it can be difficult to predict when the market will bottom out and start to recover.

Investors should also keep in mind that bear markets are a natural part of the market cycle and should not be feared. Indeed, many opportunities can arise during these periods of market weakness.

How to invest during a bear market?

Here are a few tips to help you make the most of your investment during a bear market:

1. Know your goals

When you’re investing in a bear market, it’s important to know your goals. Are you looking to invest for the long term or are you trying to take advantage of short-term opportunities? If you’re investing for the long term, you’ll want to focus on investments that will hold their value or increase in value over time. For example, companies that have strong fundamentals and are well-positioned for future growth. If you’re looking to take advantage of short-term opportunities, you’ll want to focus on investments that are more volatile and have the potential for higher returns.

2. Have a plan

When you’re investing in a bear market, it’s important to have a plan. You should know how much money you’re willing to invest and what types of investments you’re interested in. You should also have an exit strategy planned out so that you can sell your investments if they lose value.

3. Diversify your portfolio

One of the best ways to protect your portfolio during a bear market is to diversify your investments. This means investing in different types of assets, such as stocks, bonds, and cash. By diversifying your portfolio, you’ll be less likely to lose money if one type of investment loses value.

4. Be patient

When you’re investing in a bear market, it’s important to be patient. Bear markets can last for years, so it’s important to stay invested for the long term. Don’t try to time the market; Instead, focus on finding good investments that you’re comfortable holding for the long term.