What is BankNifty and Nifty50?

The Nifty50 is a stock market index consisting of the top 50 companies listed on the National Stock Exchange of India. The BankNifty is an index representing the top 30 banks in India that trade on the National Stock Exchange. Let us know more details about BankNifty and Nifty50, in this article.

Key Takeaways

- BankNifty is an index that tracks the share prices of the top banks in India.

- The Nifty50 is a stock market index that comprises of 50 Indian companies from 12 sectors.

- Both Nifty50 and BankNifty are highly liquid indices which make them ideal for day trading and short-term investments.

- Being highly liquid indices, they are often subject to high volatility which can make them risky for long-term investments.

What is BankNifty?

BankNifty is an index that tracks the share prices of the top banks in India. The index is calculated by taking the average of the share prices of the banks that are included in it. BankNifty was launched in 2005 and is one of the most popular indexes in India.

The banks that are included in the BankNifty index are HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank, and SBI. These are some of the largest and most well-known banks in India.

Investors can buy shares of the banks that are included in the BankNifty index, or they can buy ETFs that track the index. ETFs are a type of investment fund that allows investors to easily invest in a basket of assets.

The BankNifty index is a good way to get exposure to the Indian banking sector. It is a popular index that is followed by many investors.

What is Nifty50?

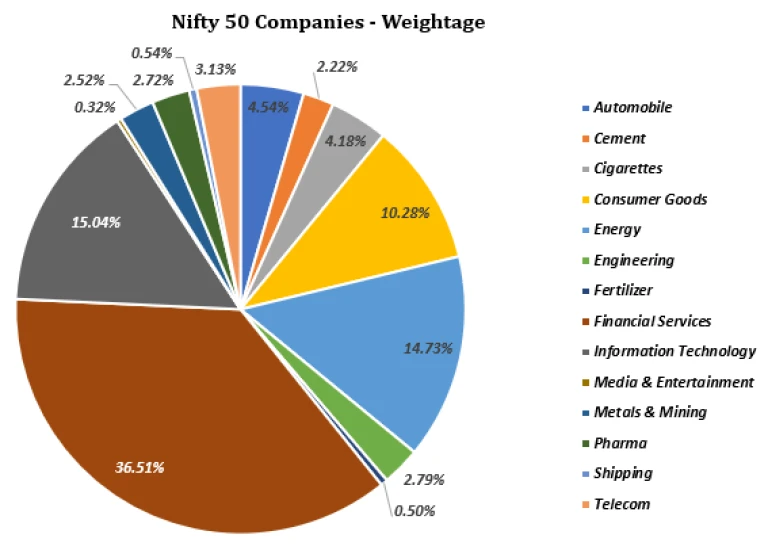

The Nifty50 is a stock market index that comprises of 50 Indian companies from 12 sectors. These companies are the large and most liquid ones that are traded on the National Stock Exchange (NSE). The Nifty50 is owned and managed by India Index Services and Products Ltd. (IISL), which is a subsidiary of NSE.

The base value of the Nifty50 index is 1000 and it was launched on April 1, 1996. The companies that are a part of this index are reviewed every six months. In order to be included in the Nifty50, a company must meet certain criteria with regard to liquidity, size, and sector representation.

The Nifty50 is widely considered to be a good barometer of the Indian economy and is often used by investors to get an idea of how the stock market is performing. It is also used by financial analysts to identify trends and make investment decisions.

The Difference Between BankNifty and Nifty50

Nifty50 is a stock market index that includes the top 50 companies listed on the National Stock Exchange of India. The companies are chosen based on their market capitalization, liquidity, and other factors.

BankNifty is a similar index that includes the top banks in India. These banks are chosen based on their size, profitability, and other factors.

The main difference between the two indices is the sector they represent. Nifty50 represents a broader range of sectors while BankNifty focuses specifically on the banking sector.

Should You Invest in BankNifty or Nifty50?

If you’re considering investing in the Indian stock market, you may be wondering whether you should put your money into the BankNifty index or the Nifty50 index. Both are popular options, but which one is right for you?

The BankNifty index consists of the top 50 banks in India, while the Nifty50 index includes the 50 largest companies listed on the National Stock Exchange of India. So, if you’re looking to invest in the banking sector, then BankNifty would be the better choice. However, if you’re interested in a more diversified portfolio, then Nifty50 would be a better option.

Both indexes have their pros and cons, so it’s important to do your own research before making any decisions. Investing in either BankNifty or Nifty50 can be a good way to get started in the Indian stock market.

Pros and Cons of BankNifty and Nifty50

Nifty50 is a stock index that comprises of 50 of the largest and most liquid Indian stocks. It is owned and managed by National Stock Exchange of India Limited (NSE). Further Nifty50 is widely considered to be a barometer of the Indian stock market.

BankNifty, on the other hand, is an index that comprises of the top 12 banks in India in terms of market capitalization. Just like Nifty50, it is also owned and managed by NSE. BankNifty is considered to be a good indicator of the overall health of the banking sector in India.

Now that we know what these two indices are, let’s take a look at their pros and cons:

Pros:

1. Both Nifty50 and BankNifty are highly liquid indices which make them ideal for day trading and short-term investments.

2. They both offer good diversification opportunities as they comprise of stocks from different sectors.

3. Nifty50 is a good gauge of the overall health of the Indian stock market while BankNifty gives insights into the banking sector specifically.

Cons:

1. Being highly liquid indices, they are often subject to high volatility which can make them risky for long-term investments.

2. They both have a limited number of stocks which may not be representative of the entire market.

Conclusion

Finally, BankNifty and Nifty50 are two of the most popular stock indexes in India. They offer investors a way to track the performance of the Indian stock market, and can be used as a benchmark for investment purposes. While both indexes have their pros and cons, they are both excellent options for those looking to get exposure to the Indian stock market.