What is BSE Sensex and How it works?

The SENSEX is a stock market index that is widely used to measure the performance of the Bombay Stock Exchange (BSE). It is a basket of 30 stocks that represent major sectors of the Indian economy. The SENSEX is often referred to as the “Sensex” or the “BSE Sensex”. This article will focus on briefly understanding BSE Sensex.

Key Takeaways

- The BSE Sensex, also known as the Bombay Stock Exchange Sensex, is a stock market index that is calculated based on the prices of 30 large and well-established companies that trade on the Bombay Stock Exchange.

- The BSE Sensex is widely considered to be a barometer of the Indian economy and is one of the most closely watched stock market indices in the world.

What is the BSE Sensex?

The BSE Sensex, also known as the Bombay Stock Exchange Sensex, is a stock market index that represents the weighted average of 30 large and well-established companies listed on the Bombay Stock Exchange (BSE). These companies span a variety of sectors, including banking, energy, pharmaceuticals, and steel. It is one of the most closely watched stock market indices in the world.

History of Bombay Stock Exchange

BSE is a stock market index that is considered to be a benchmark for the Indian stock market. The index is composed of 30 of the largest companies listed on the Bombay Stock Exchange. The BSE Sensex is calculated using a free-float capitalization method, which means that only those shares that are available for trading are used in the calculation. This method gives a true picture of the market capitalization of companies and reflects the actual price of their shares.

How is the BSE Sensex calculated?

The BSE Sensex, also known as the Bombay Stock Exchange Sensex, is a stock market index that is calculated based on the prices of 30 large and well-established companies that trade on the Bombay Stock Exchange. These companies are chosen based on their market capitalization, liquidity, and sector representation. It is used as a barometer for the Indian stock market and is often used to refer to the stock market in general.

The BSE Sensex is calculated using a base value of 100, which was first published on January 1, 1986. This base value is then adjusted according to the changes in the prices of the 30 component stocks. The weightage of each stock in the index is determined by its market capitalization.

How has BSE Sensex performed in recent years?

Since its inception in 1986, the BSE Sensex has been one of the best performing indices in the world. Over the past few years, it has delivered returns of over 20% per year (Excluding pandemic). This has been driven by strong economic growth in India, which has resulted in strong corporate earnings growth.

Looking forward, analysts expect it to continue to outperform other global indices. This is based on expectations that India’s economy will continue to grow at a faster rate than developed economies such as the United States and Europe.

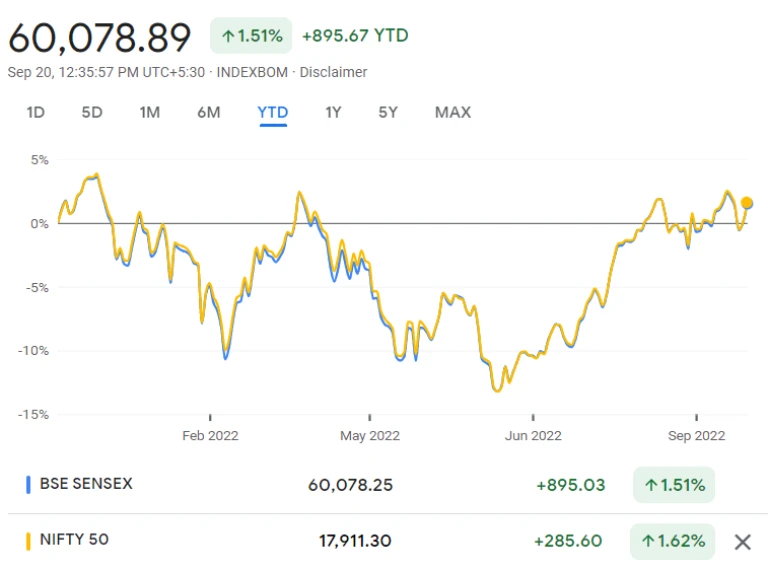

As of september 2022, BSE is performing stable with an increase of 3.95% – compared to the year beginning. It is fairly better performance when compared to other global indexes.

How to invest in the BSE Sensex?

It is a stock market index that tracks the performance of 30 major companies listed on the Bombay Stock Exchange. The index is widely considered to be a barometer of the Indian stock market and is used by investors around the world to get a sense of how the market is performing.

If you’re interested in investing in the BSE Sensex, there are a few things you need to know. First, you’ll need to open an account with a broker that offers access to the Bombay Stock Exchange. Once you have an account set up, you can begin buying and selling shares of companies listed on the Sensex.

When investing in the BSE Sensex, it’s important to keep in mind that it’s a volatile market. This means that share prices can go up and down rapidly, so it’s important to have a risk management strategy in place. One way to minimize risk is to invest for the long term rather than trying to time the market.

Which is better BSE or NSE?

There are two main stock exchanges in India, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Both have their own strengths and weaknesses, so it’s hard to say which one is better. NSE is generally seen as more modern and efficient, while BSE has a longer history and more personal feel. It really depends on your own preferences as an investor.

As you can clearly see in the chart, there is not much of a difference between the indexes. Year to date performance (september 2022) of both index is quite similar to each other.

SENSEX is a key index of the BSE, which is one of the largest stock exchanges in India. It is made up of 30 of the most well-known and reputable companies listed on the BSE, which makes it a reliable indicator of market performance. If you’re looking to get an idea of how the Indian stock market is doing, checking the SENSEX is a good place to start.