What is the DJIA or Dow Jones Index?

The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock market indices in the world. But what is it exactly, and why is it so important? In this article, we’ll take a look at the Dow Jones and how it can be used as a valuable tool for stock investors.

Key Takeaways

- The Dow is made up of 30 large publicly-traded companies. These companies are chosen by the editors of The Wall Street Journal based on their size, market share, and industrial sector.

- Dow Jones was founded in 1882 by Charles Dow, Edward Jones, and Charles Bergstresser.

- DJIA has a 10 yearly annualized average return of 15% and also a 7% 20-year annualized average return.

- UnitedHealth Group Inc. is the top component of the DJIA by weightage. of 11.13% in the index.

Who Is Dow Jones?

Dow Jones is one of the essential names in the stock market. But who is Dow Jones, and what does this name mean for investors?

It was founded in 1882 by Charles Dow, Edward Jones, and Charles Bergstresser. The company started as a news wire service that provided information to investors about the stock market. In 1896, the first ever stock average was launched, which tracked the performance of 12 major companies. This average became known as the Dow Jones Industrial Average (DJIA), and it is still used today to track the stock market’s performance.

The DJIA is often referred to as “The Dow” or simply “The market.” It is one of the financial indicators that are most carefully followed worldwide, and it is used by investors to make decisions about buying and selling stocks. When the Dow goes up, it means that stocks are generally doing well. When the Dow goes down, it means that stocks are generally doing poorly.

The Dow is made up of 30 large publicly-traded companies. These companies are chosen by the editors of The Wall Street Journal based on their size, market share, and industrial sector. The DJIA is a price-weighted index, which means that the companies with the highest stock prices have the biggest impact on the index. The current value of the DJIA is 30,961.

What Is Dow Jones?

The Dow Jones is a price-weighted average of 30 blue-chip stocks that are traded on the New York Stock Exchange (NYSE).

It is also important because it can be used to predict future economic activity. If the Dow Jones is rising, it is often an indication that the economy is doing well and that businesses are optimistic about the future. This can lead to increased investment and hiring, which can further boost the economy.

What is The Dow Jones Industrial Average (DJIA)?

The Dow Jones Industrial Average, or DJIA, is a collection of 30 blue chip stocks that are chosen by the editors of the Wall Street Journal. These stocks are meant to represent the overall performance of the US stock market.

With only 12 firms, largely in the industrial sectors, the DJIA was first introduced. However, it eventually expanded to 30 companies. The initial businesses engaged in producing oil, gas, sugar, tobacco, cotton, and railways.

The Dow Jones Indexes were purchased by S&P Dow Jones Indices LLC in 2012. A joint venture between the controlling member CME Group and S&P Global is known as S&P Dow Jones Indices LLC.

What is the Meaning of Dow in the Stock Market?

The Dow Jones Industrial Average (DJIA) is one of the oldest and most well-known stock market indices in the United States. It consists of 30 large, publicly traded companies that are considered to be leaders in their respective industries. The index is often used as a barometer for the overall health of the stock market and the economy.

The term “Dow” is actually an abbreviation for “down-payment,” which was originally used in reference to the average price of a barrel of oil. Over time, the meaning of Dow has evolved to become associated with the stock market index that bears its name.

There are a number of reasons why the Dow is important in stock investing. Because the Dow includes some of the largest and most influential companies in America, it can be seen as a good proxy for how these companies are performing.

Finally, many investors use the Dow as a benchmark against which they measure the performance of their own portfolios. By knowing how their investments are doing

Which Sector Companies Are included in the Dow Jones?

The companies that make up the DJIA are spread across a variety of industries, including:

- Aerospace and defense

- Financial services

- Consumer goods

- Industrials

- Health care

- Information technology

- Materials

- Telecommunications

The DJIA is important because it is one of the most widely-followed stock market indexes in the world. Many professional investors use the DJIA as a benchmark for how the overall stock market is performing.

Historic Performace of Dow Jones Industrial Average.

The Dow Jones Industrial Average was first established on May 26, 1896. The index’s average yearly return up through May 25 was 5.42%. Naturally, this has changed throughout time. The index had an average yearly return of 7.55% for the 25-year period ending January 6, 2012. Prior to 1987, there were 91 years with an average yearly return of roughly 4.3%.

DJIA has a 10 yearly annualized average return of 15% and also a 7% 20-year annualized average return.

Top components of Dow Jones for 2022

Following are the Top Components of the Dow Jones Index;

- UnitedHealth Group Inc. (UNH)

- Goldman Sachs Inc. (GS)

- Home Depot Inc. (HD)

- McDonald’s Corporation (MCD)

- Microsoft Corporation (MSFT)

- Amgen Inc. (AMGN)

- Visa Inc. class A (V)

- Caterpillar (CAT)

- Honeywell International (HON)

- Johnson & Johnson (JNJ)

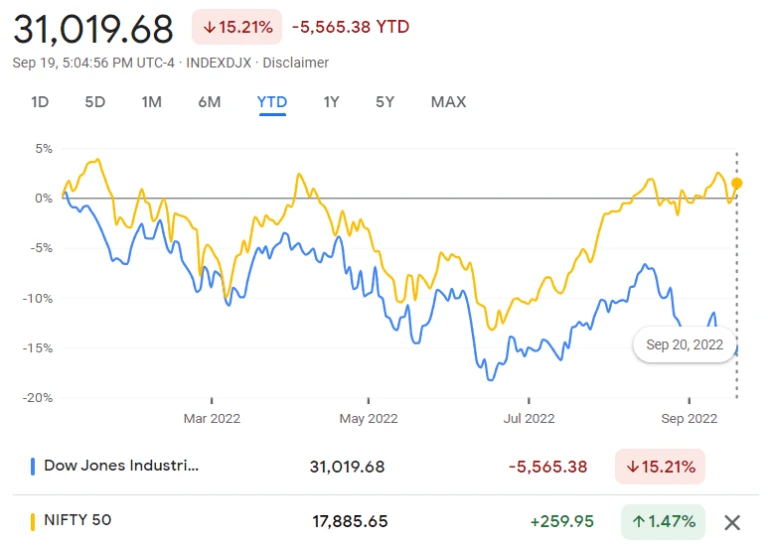

Dow Jones performance in 2022

As of September 15, 2022, the Dow Jones Industrial Average is now trading for 30,961.82 points. However, It started the year with 36,585.06 points. It has seen a drop of more than 5000 points and it is about -14.8% annual change. It has a year low of 29,888.78 and a year high of 36,799.65. However, DJIA’s Year high was recorded in the first week of the year itself, and after that index has seen a drastic fall, recording its year low in the month of June.

How to Buy Shares in the Dow Jones Industrial Average in India?

If you are an Indian investor interested in buying shares in the Dow Jones Industrial Average, there are a few things you need to know.

First, you need to open a brokerage account with a US-based broker that offers access to the New York Stock Exchange (NYSE). Once you have done this, you will be able to buy shares in the Dow Jones Industrial Average through that broker. Keep in mind that you may be subject to currency conversion fees when buying stocks on the NYSE, so it’s important to compare fees before deciding which broker to use.

Once you have opened a brokerage account, you can start researching which stocks to buy. When looking at the DJIA, you will want to pay attention to the individual components of the index. These are the 30 largest and most influential companies in the United States. So they can give you a good idea of how different sectors are performing. For example, if you see that the financial sector is underperforming, you might want to consider investing in other sectors such as healthcare or technology.

Once you have decided which stocks to buy, you will need to place an order with your broker. You will need to specify the number of shares you want to purchase, as well as the price you are willing to pay. Your order will be executed when the market opens on the following trading day.

Dow Jones vs Nifty 50

The DJIA includes companies from a range of different industries, while the Nifty 50 focuses on companies from only the Indian stock market. Additionally, the DJIA is calculated using price data from only New York Stock Exchange-listed companies, while the Nifty 50 includes price data from both Bombay Stock Exchange and National Stock Exchange-listed companies.

The weighing methodologies for these two indices are different. DJIA is a price-weighted index, meaning that stocks with higher prices have a greater influence on the index’s movement.

Nifty 50 has an annualized return of 12% for 20 years. While compared to 7% of DJIA. Individual investors should think about investing in an ETF that is linked to the Dow Jones Industrial Average if they wish to expand their financial knowledge, obtain more practical investment experience, and take charge of their own personal investment objectives. Whereas Investors that desire capital growth with little volatility can opt for the Nifty 50.

As of September 2022, Nifty 50 is performing notably well compared to DJIA. DJIA is 15.21% down since the beginning of the year. Meanwhile, Nifty 50 is performing stable with the rise of 1.47%. (Refer the above chart)