What is Nikkei 225 and How it works?

The Nikkei, also known as the Japanese stock market, is one of the most important in the world. In this article, we’ll take a look at its history and performance, so that you can better understand how it works.

Key Takeaways

- The Nikkei is a Japanese stock market index that tracks the performance of 225 large companies listed on the Tokyo Stock Exchange.

- The index is calculated by taking the average of the closing prices of the 225 largest and most active companies listed on the Tokyo Stock Exchange.

- It is a price-weighted index, meaning that stocks with a higher price have a greater impact on the index.

- Fast Retailing Co., Ltd, Tokyo Electron Ltd and Softbank Group Corporation are 3 of the top components on Nikkei 225.

What is Nikkei 225?

The Nikkei is a Japanese stock market index that tracks the performance of 225 large companies listed on the Tokyo Stock Exchange. The index is widely regarded as a key indicator of the Japanese economy and is often used as a benchmark for other Asian markets.

The Nikkei has a long history, dating back to its launch in 1876. It was originally known as the “Tokyo Stock Price Index”, and was only available in Japanese. In 1999, the index was renamed “Nikkei 225”, in line with its new status as a global market indicator.

Since its inception, it has been one of the world’s most volatile indexes, experiencing numerous highs and lows. In recent years, it has been on a steady upward trend, reaching a record high in 2015. However, it remains to be seen how the index will perform in the future, given the current economic conditions in Japan.

Nikkei’s Historic Performances

The Nikkei is a Japanese stock market index that is widely used as a measure of the performance of the Japanese stock market. The Nikkei is also known as the Tokyo Stock Price Index (TOPIX). It consists of 225 stocks of companies listed on the first section of the Tokyo Stock Exchange.

The history of the Nikkei can be traced back to May 1949, when it was first published by the Nihon Keizai Shimbun, Japan’s leading business newspaper. It was initially calculated based on the prices of just 16 stocks but has since expanded to include 225 stocks.

The Nikkei has been a volatile index, but its overall performance has been positive. Between 1949 and 1989, the Nikkei experienced six bull markets and six bear markets. However, since 1990, it has been in a bull market for all but two years (2000 and 2008).

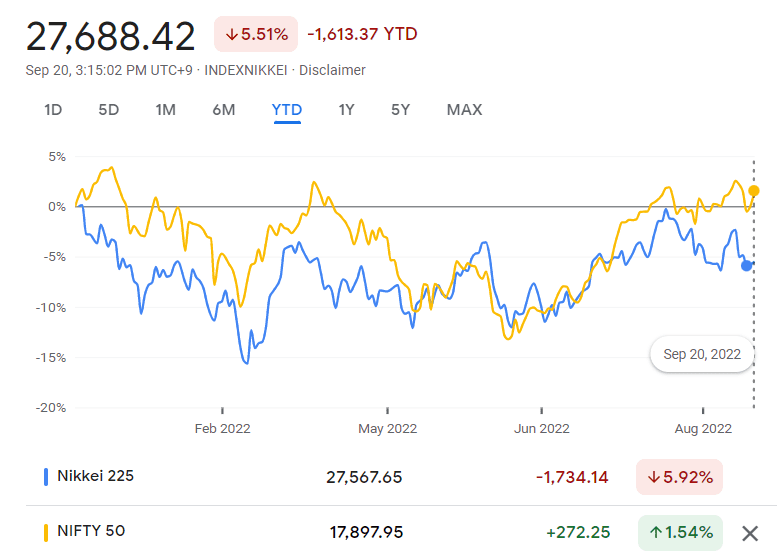

In recent years, it has been one of the best-performing major stock indices in the world. In 2017, it was up 19.1%, while in 2018 it was up 7.1%. So far in 2022 it is down by -5.92%.

The Nikkei’s all-time high was 38,916.87, reached on December 29, 1989. The Nikkei’s all-time low was 7,054.98, reached on April 28, 2003.

How does the Nikkei index work?

Nikkei 225 has a base value of 1000 as of February 7, 1975. The index is calculated by taking the average of the closing prices of the 225 largest and most active companies listed on the Tokyo Stock Exchange.

The Nikkei 225 Index is calculated using a price-weighted average. This means that stocks with a higher price have a greater impact on the index than stocks with a lower price. The index is reviewed every year, and companies are added or removed from the index based on their market capitalization.

The index is updated every 5 seconds during trading hours. It is also reviewed and rebalanced every quarter.

Facts about Nikkei

It is a widely used benchmark for the Japanese stock market and is often referred to as the “Japanese Dow Jones.”

The Nikkei was founded in 1950 and it is currently calculated by the Nihon Keizai Shimbun (Nikkei) newspaper. Further, It is a price-weighted index, meaning that stocks with a higher price have a greater impact on the index.

The Nikkei has a long history, dating back to the Meiji Period in Japan. The Meiji Period was a time of great transformation for Japan, as it modernized and began to Westernize. One of the key aspects of this modernization was the introduction of Western-style financial markets and businesses.

The Nikkei 225 was created in May of 1949, just before Japan’s entry into the Korean War. The index was created as a way to track the performance of Japanese stocks and it quickly became a popular benchmark.

The Nikkei has experienced several periods of volatility over its history. Perhaps the most well-known period of volatility came during the “Lost Decade” of the 1990s when the Japanese economy stagnated and it fell by over 60%.

More recently, it was one of the worst-performing major indexes during the global financial crisis of 2008-2009. However, the index has recovered in recent years and is once again near its all-time highs.

Nikkei 225 vs Nifty 50

As of September 2022, Nifty 50 is performing better compared to Nikkei 225 (Year to date basis). Nifty 50 is performing stably as compared to Nikkei. It has fallen by 5.92% since the beginning of the year 2022.

Top Components of Nikkei Index by Weight

Following are the top components of Nikkei by weightage in the index

- Fast Retailing Co., Ltd.

- Tokyo Electron Ltd.

- Softbank Group Corporation

- KDDI Corporation

- Daikin Industries, Ltd.

- FANUC Corporation

- Terumo Corporation

- Shin-Etsu Chemical Co., Ltd.

- Kyocera Corporation

- Advantest Corporation

Who should invest in Nikkei?

There is no simple answer to the question of who should invest in Nikkei. The key is to have a clear understanding of your investment goals and objectives, as well as your own risk tolerance. If you’re comfortable with a high degree of risk, then investing in this may be a good option for you. However, if you’re more conservative, you may want to reconsider. Ultimately, it’s important to do your own research and make a decision that’s right for you.

The Nikkei is a crucial part of Japan’s economy, and its history is long and complex. Its performance has been mixed in recent years, but it remains an important player in the global market. If you’re interested in investing in Japan, or if you’re simply curious about the country’s economy, it is definitely worth keeping an eye on.