What is Euronext and Euronext 100?

Euronext is the largest stock exchange group in Europe and also one of the biggest in the world. In this article we will be looking into its history, performance and more.

Key Takeaways

- Euronext is a pan-European stock exchange based in Amsterdam, Brussels, London, Lisbon and Paris.

- As of May 2021, it was the largest stock exchange in Europe with 1,300 listed companies and a market capitalization of 6.41 Trillion USD.

- Its majority is owned by Intercontinental Exchange (ICE), a US-based company that also owns the New York Stock Exchange.

- Royal Dutch Shell plc, Nestlé SA and Unilever NV are 3 of the top components of Euronext.

What is Euronext?

Euronext is a pan-European stock exchange based in Amsterdam, Brussels, London, Lisbon and Paris. It was formed in 2000 through the merger of the Amsterdam Exchanges, Brussels Exchanges, and the Paris Bourse, and is now part of the Intercontinental Exchange. It operates regulated markets, marketplaces, and trading platforms.

As of May 2021, it was the largest stock exchange in Europe with 1,300 listed companies and a market capitalization of 6.41 Trillion USD. The company is a member of the World Federation of Exchanges and the European Federation of Exchanges.

Some of the top companies listed on Euronext include Royal Dutch Shell, Unilever, Total, Airbus Group, and BNP Paribas.

History of Euronext

Euronext is a pan-European stock exchange operator with subsidiaries in Belgium, France, the Netherlands, Portugal and the United Kingdom. The company was created in 2000 through a merger of the Amsterdam Stock Exchange, Brussels Stock Exchange, Paris Bourse and the Portuguese stock exchange.

It has a long and rich history dating back to the early days of stock trading in Europe. The Amsterdam Stock Exchange was founded in 1602, making it one of the oldest stock exchanges in the world. The Brussels Stock Exchange was established in 1801, while the Paris Bourse traces its origins back to 1724. These three exchanges merged in 2000 to form Euronext.

Its majority is owned by Intercontinental Exchange (ICE), a US-based company that also owns the New York Stock Exchange. Other major shareholders include Citigroup, Goldman Sachs, and Morgan Stanley.

Today, it is the largest stock exchange in continental Europe with a market capitalization of over €6 trillion. The exchange offers trading in a wide range of assets including equities, bonds, derivatives and commodities. It is also home to some of Europe’s largest companies including BNP Paribas, Total and Vinci.

What is Euronext 100?

Euronext 100 Index is the blue chip index of the Pan-European market.

It consists of the biggest and most actively traded equities on Euronext. Each stock must trade more than 20% of its outstanding shares throughout the rolling 12-month analysis period. A size and liquidity examination of the investment universe is employed to analyse the index on a quarterly basis. Each stock in the index has a sector classified to it.

Performance of Euronext

Euronext has a long history of strong performance. In its first year of operation, Euronext’s total market capitalization rose by 27%. In 2001, It was the best performing stock exchange in Europe with a total return of 18%. And in 2002, it again outperformed other European peers with a total return of nearly 24%.

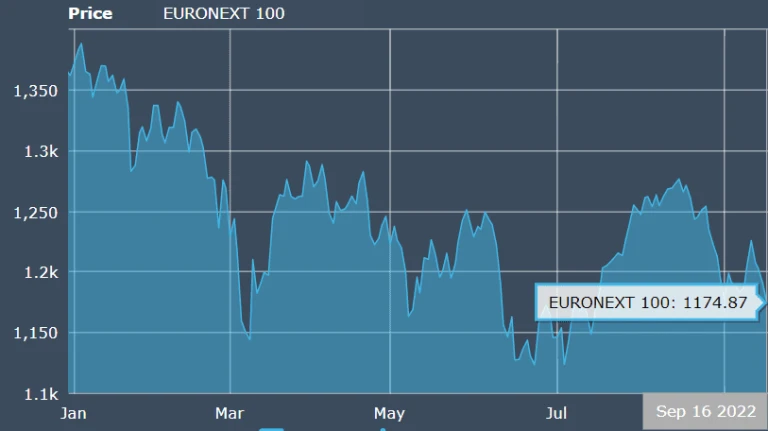

Euronext’s present performance is just as impressive. In 2019, it was once again the best performing stock exchange in Europe with a total return of nearly 30%. However, in september 2022, Euronext100 is at 1174 points; Almost 14.5% fall since beginning of the year.

The exchange has a strong history of performance. In the past decade, it has outperformed both the US and UK stock markets. And since its inception in 2000, it has delivered an annualized return of 7%.

Top components of Euronext

Euronext is a pan-European stock exchange based in Amsterdam, Brussels, Dublin, Lisbon, London and Paris. It is the largest stock exchange in Europe and the 11th largest in the world by market capitalization.

The top companies on Euronext are:

- Royal Dutch Shell plc

- Nestlé SA

- Unilever NV

- Total SA

- Anheuser-Busch InBev SA/NV

- Kering SA

- Danone SA

- Airbus SE

- Engie SA

- Vinci SA

Euronext Single Indices:

There are many different indexes in Euronext, each one representing a different segment or sector of the market. The most popular index is the CAC40 which represents the top 40 companies listed on the exchange. Other popular indexes include the AEX25, BEL20, and PSI20.

No matter what your investment goals are, there is likely an index in Euronext that can help you measure your success. Indexes provide valuable insight into the overall performance of the market and can help you make more informed investment decisions.

Who can trade on Euronext?

Investment banks, retail banks and brokers, independent trading companies, liquidity providers, market makers, and regional brokerage firms are some of the trading members of Euronext.

Euronext vs National Stock Exchange India

India’s National Stock Exchange (NSE) is the largest stock exchange in the country, with a market capitalization of over US$3 trillion. Euronext is the largest stock exchange in Europe, with a market capitalization of over US$6 trillion. Both exchanges offer a wide range of products and services to their listed companies and investors.

NSE was established in 1992 and has since grown to become one of the leading stock exchanges in the world. Euronext was established in 2000 through the merger of four European stock exchanges. Both exchanges are leaders in their respective markets and offer a variety of products and services to listed companies and investors.

NSE offers trading in a wide range of instruments, including equities, derivatives, debt, and currency products. It also provides clearing, settlement, and depository services. Euronext offers trading in equities, derivatives, ETFs, bonds, and commodities. It also provides clearing, settlement, custody, and other services.

This year, so far Euronext 100 is under performing. It is at 14.42% fall since the beginning of the year. Meanwhile Nifty 50 is stable with 1.35% raise since the beginning of the year 2022.