What is an Exchange Traded Fund (ETF)?

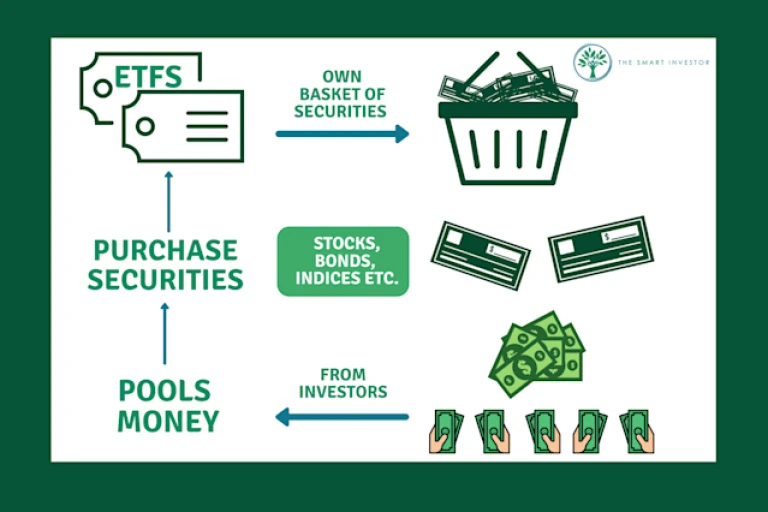

An Exchange Traded Fund (ETF) is a type of mutual fund that trades on a stock exchange like any other security. Unlike stocks, ETFs are not owned by the individual who buys them but rather by the funds that own them. This allows ETFs to track an index more closely than traditional mutual funds, which can provide investors with increased diversification and reduced risk.

What is an Exchange Traded Fund?

ETFs are often used to help investors diversify their portfolios by investing in a variety of different types of securities. ETFs offer many of the same benefits as traditional mutual funds, but they also have some unique features that make them especially useful for certain types of investors.

One major advantage of ETFs is that they are very easy to use. Most ETFs are traded just like stocks, which means that you can buy and sell them at any time. This makes them a great way to add exposure to a particular sector or market index. Another big advantage of ETFs is that they typically offer lower fees than traditional mutual funds. This makes them a good option for investors who want to minimize their expenses.

What are the types of Exchange Traded Funds?

An Exchange Traded Fund, or ETF for short, is a type of mutual fund that trades on stock exchanges like the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE). ETFs are popular because they offer an easy way for individual investors to invest in a diversified basket of stocks. They are also a good option for retirement accounts because they can provide returns that track the performance of a particular index, such as the S&P 500 or the Dow Jones Industrial Average.

There are three main types of ETFs: Standardized, Actively Managed, and Inverse.

Standardized ETFs track a specific benchmark, such as the S&P 500 or the Nasdaq-100. Active Management ETFs are typically managed by professional money managers. These often have lower fees than standard ETFs. Inverse ETFs are designed to move opposite to the performance of a specific benchmark. For example, if the S&P 500 is going up, an inverse ETF will go down, and vice versa.

How to buy Exchange Traded Fund?

If you are looking to invest in an Exchange Traded Fund (ETF), you will likely need to first purchase a qualifying investment vehicle, such as a mutual fund or exchange-traded note. A good way to buy an ETF is through a brokerage account. Here’s how to do it:

1) Open a brokerage account and add the ETF to your basket of investments.

2) Navigate to the ETF’s website and find information on the fees associated with investing in the ETF.

3) Compare the fees associated with buying the ETF through your brokerage account versus purchasing it directly from the fund company.

4) Make sure you understand how the ETF works before investing. For example, some ETFs track a specific index while others are designed to provide returns that are similar to those of certain stocks or bonds.

What are the benefits of an Exchange Traded Fund?

ETFs are usually much cheaper than regular mutual funds. They also offer some unique benefits that can make them a better investment for certain investors. Here are some of the most common benefits of ETFs:

1. ETFs are very easy to trade. You can buy and sell them just like stocks. This means one can quickly and easily move money between investments.

2. ETFs usually have lower fees than regular mutual funds. This is because ETFs are traded on exchanges, which means they don’t have to pay the large management fees that Mutual Funds charge.

3. ETFs give you more exposure to different types of investments than regular mutual funds. This can lead to more diversification and stability in your portfolio, which could make you more comfortable with the risks involved in investing.

What is the best Exchange Traded Fund?

An Exchange Traded Fund, or ETF, is a type of mutual fund that trades on the stock market. ETFs are perfect for investors who want to invest in a diverse range of securities without having to worry about tracking individual stocks. There are dozens of different ETFs to choose from, so it’s important to do your research before investing. Here two five of the best Exchange Traded Funds currently available:

1. SPDR S&P 500 ETF (SPY)

The SPDR S&P 500 ETF (SPY) is one of the most popular ETFs on the market. It tracks the performance of the Standard & Poor’s 500 Index, which is one of the most widely-followed indices in the world. This fund has an average annual return of around 9%.

2. Vanguard Total Stock Market ETF (VTI)

The Vanguard Total Stock Market ETF (VTI) is another excellent option for investors who want to invest in a wide range of securities. This fund tracks the performance of the MSCI EAFE Index, which includes stocks from 23 countries across Europe and Asia. The VTI has an average annual return of around 7%.